The Best Strategy To Use For Transaction Advisory Services

Some Known Factual Statements About Transaction Advisory Services

Table of ContentsTransaction Advisory Services for BeginnersThe smart Trick of Transaction Advisory Services That Nobody is DiscussingFascination About Transaction Advisory Services6 Simple Techniques For Transaction Advisory ServicesThe Definitive Guide to Transaction Advisory Services

This action makes certain business looks its best to potential buyers. Getting the organization's worth right is important for a successful sale. Advisors utilize various techniques, like discounted cash flow (DCF) analysis, contrasting with comparable companies, and current transactions, to figure out the fair market price. This aids set a fair cost and bargain effectively with future buyers.Purchase experts action in to aid by getting all the needed information organized, addressing concerns from buyers, and preparing check outs to the business's location. This constructs depend on with buyers and keeps the sale relocating along. Getting the best terms is crucial. Transaction advisors utilize their experience to assist business proprietors manage challenging arrangements, satisfy customer expectations, and framework deals that match the owner's objectives.

Meeting legal policies is important in any business sale. They help service owners in preparing for their following actions, whether it's retired life, starting a new endeavor, or handling their newly found wealth.

Transaction advisors bring a wealth of experience and expertise, making sure that every facet of the sale is taken care of properly. With calculated prep work, appraisal, and negotiation, TAS helps company owner attain the greatest possible price. By making sure legal and regulative compliance and handling due diligence alongside various other offer team participants, purchase experts reduce potential threats and responsibilities.

Not known Details About Transaction Advisory Services

By comparison, Large 4 TS groups: Service (e.g., when a possible customer is performing due diligence, or when a bargain is shutting and the purchaser requires to incorporate the firm and re-value the vendor's Annual report). Are with charges that are not linked to the offer closing successfully. Make costs per involvement someplace in the, which is much less than what investment financial institutions make even on "little offers" (yet the collection chance is likewise much higher).

, but they'll focus much more on bookkeeping and assessment and much less on subjects like LBO modeling., and "accounting professional only" topics like trial equilibriums and just how to stroll through occasions making use of debits and credit reports rather than monetary declaration changes.

Things about Transaction Advisory Services

Professionals in the TS/ FDD groups may additionally speak with monitoring regarding every little thing over, and they'll write a comprehensive record with their findings at the end of the procedure.

, and the general shape looks like this: The entry-level role, where you do a whole lot this article of information and financial analysis (2 years for a promo from here). The next degree up; similar job, yet you get the more interesting little bits (3 years for a promo).

Particularly, it's difficult to obtain advertised past the Manager level since couple of individuals leave the job at that stage, and you need to start Transaction Advisory Services revealing proof of your capacity to create revenue to development. Allow's begin with the hours and way of living since those are simpler to describe:. There are occasional late nights and weekend work, yet absolutely nothing like the agitated nature of financial investment financial.

There are cost-of-living modifications, so expect lower compensation if you're in a less costly place outside major monetary (Transaction Advisory Services). For all positions except Partner, the base salary consists of the mass of the overall compensation; the year-end reward could be a max of 30% of your base salary. Frequently, the very best means to raise your incomes is to change to a various firm and work out for a greater salary and bonus offer

Little Known Facts About Transaction Advisory Services.

You could enter company development, however financial investment banking obtains more hard at this stage due to the fact that you'll be over-qualified for Expert roles. Business money is still an option. At this stage, you must simply remain and make a run for a Partner-level duty. If you intend to leave, possibly relocate to a client and do their assessments and due persistance in-house.

The main trouble is that since: You typically need to join one more Large 4 group, such as audit, and job there for a couple of years and after that relocate into TS, work there for a few years and after that relocate into IB. And there's still no assurance of winning this IB function due to the fact that it relies on your region, clients, and the employing market at the time.

Longer-term, there is likewise some danger of and due to the fact redirected here that assessing a business's historical financial information is not specifically rocket science. Yes, people will always require to be involved, yet with advanced modern technology, reduced headcounts might possibly sustain client involvements. That said, the Deal Providers group beats audit in regards to pay, work, and departure possibilities.

If you liked this write-up, you may be thinking about reading.

Transaction Advisory Services - Truths

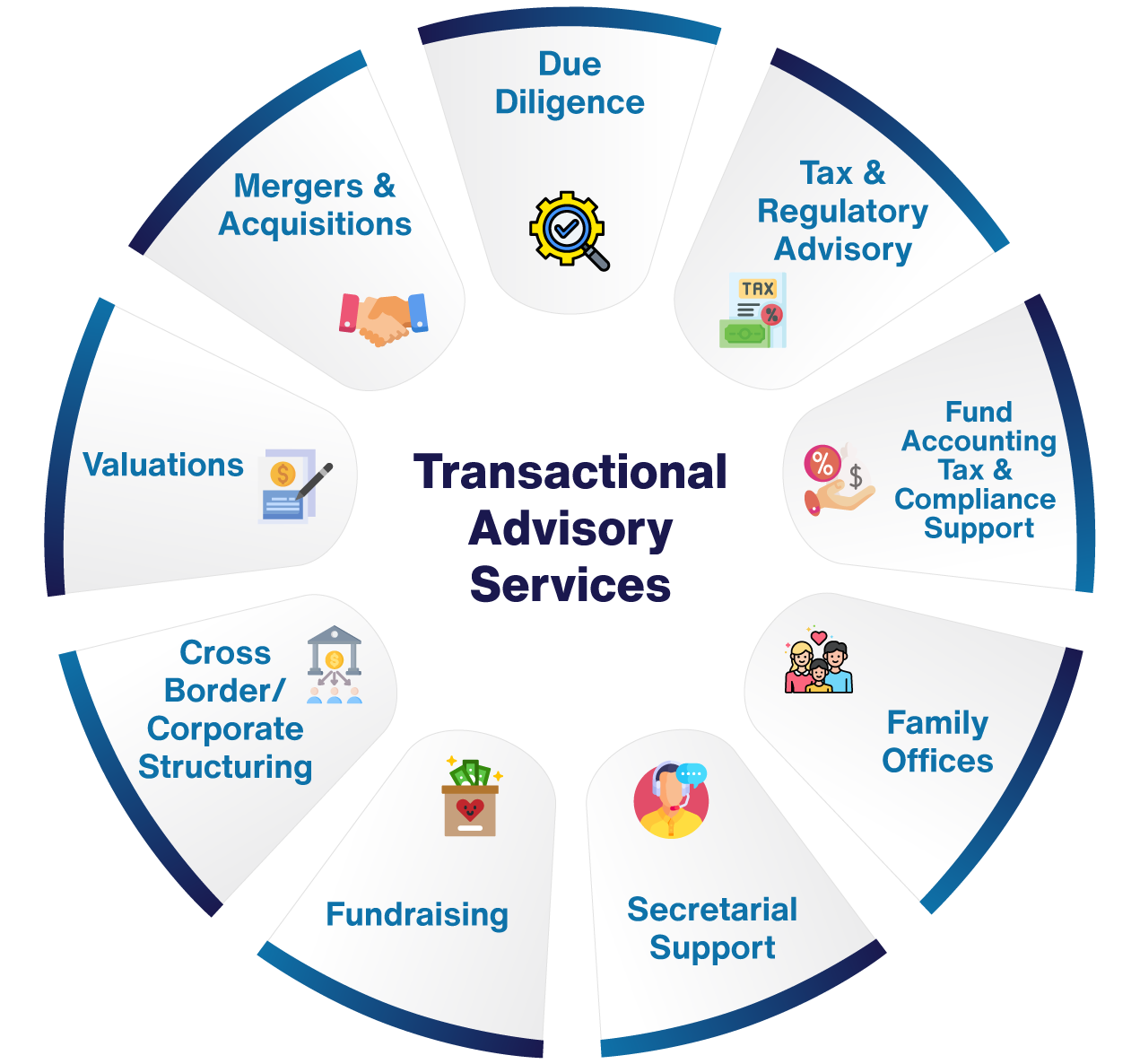

Establish advanced monetary structures that assist in determining the real market worth of a company. Offer consultatory operate in relationship to organization valuation to aid in negotiating and prices structures. Discuss the most ideal type of the deal and the type of factor to consider to utilize (money, stock, gain out, and others).

Do integration preparation to figure out the procedure, system, and organizational changes that might be called for after the bargain. Establish guidelines for integrating departments, modern technologies, and organization procedures.

Determine potential decreases by reducing DPO, DIO, and DSO. Examine the potential consumer base, industry verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence uses crucial insights right into the functioning of the firm to be acquired concerning risk evaluation and value development. Identify temporary alterations to funds, banks, and systems.